If you have a Tax Slip that shows Box 048 Fees For Services or Box 020 Self-Employed Commissions, then this is income that must be claimed as self-employed using the T2125 worksheet, that will allow you to also claim business expenses, including business use of home (includes a portion of your expenses for rent, internet, utilities, telephone, and banking expenses).

Having a small amount of this type of income can be very beneficial to your results, especially if you also have full-time income that is taxed on your paychecks – because this limited amount of business activity is more likely to have a business loss (after expenses, including home office), which will reduce your taxes owing.

For more details and information, Please Click the CRA website here: Tax slip T4A Box 048 Fees For Services

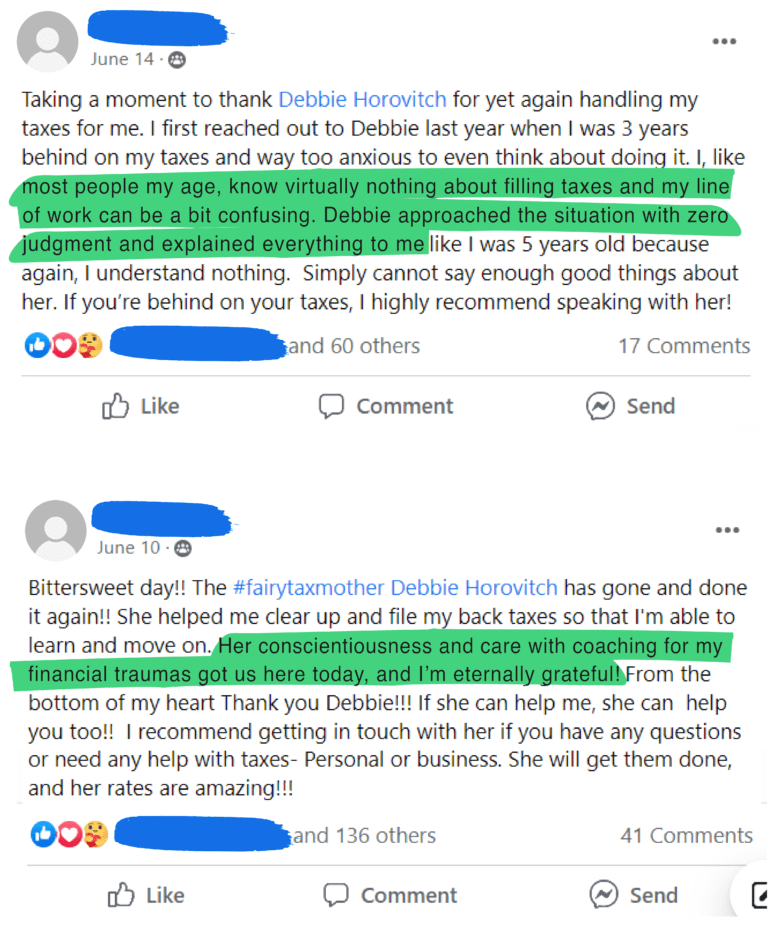

Tax Fairy Godmother

Debbie Horovitch