Tax Fairy Godmother® — trusted by over 750 Canadians in the past 5 years to free themselves from tax chaos and shame, to clarity and confidence. After overcoming her own struggles (being 10 years behind on her own sole-proprietorship filings & HST returns), with the CRA, shame, and financial anxiety, she now helps self-employed and Canadians clients catch up and gain control.

DEBBIE HOROVITCH

CRA Authorized Representative

Offering tax preparation services who are

- 5 to 10 Years Behind

- Self-Employed

- With ADHD, Money Trauma and Anxiety

Meet Debbie, Your Tax Fairy Godmother®

Debbie’s mission is to make taxes simple—empowering you to feel confident, capable, and financially free from shame, limiting beliefs, and worries about future CRA hassles.

Ways Tax Fairy Godmother® Helps Clients:

- Increased personal confidence from adulting well and managing your life and your money

- Sleep better at night knowing your taxes are accounted for and your books are in order

- Finally begin to move forward with your BIG life plans that will require money to execute

- Taxes become less scary and overwhelming, and can even become a source of EMPOWERMENT & SELF-ESTEEM

Get your Free Ebook 21 Tax Tips for Winning Financial Confidence

and Join our mailing list!

21 Tax Tips I’ve learned over the past 3 years, from working with more than 500 clients, and well over 1500+ filed returns. Once you KNOW these tips you can apply them in everyday life.

FULLY VIRTUAL TAX OFFICE

Canada’s Tax Fairy Godmother, operated by Debbie Horovitch, is a fully virtual tax office founded & operating from Toronto, Ontario, Canada.

Services

- Personal T1 Tax Returns

- Self-Employed (Sole-Proprietor) T1 Returns

- GST/HST Returns

- Adjustments to previously filed returns missing info

- Voluntary Disclosures Program applications

A tax preparation service based in Canada specializing in helping people: 5 to 10 years behind, self-employed, or who have ADHD, money trauma, and anxiety dealing with CRA.

FULLY VIRTUAL TAX OFFICE

Canada’s Tax Fairy Godmother, operated by Debbie Horovitch, is a fully virtual tax office founded & operating from Toronto, Ontario, Canada.

How It Works (My Tax Fairy Godmother® Process)

Chat

Confirm I am suited to help you with your specific & unique tax situation * FB Messenger or Email ONLY * T1 personal & self-employed only

Call Deposit Payment & Schedule

$175 +HST or $375 +HST (sole-proprietor) > this fee will turn into a deposit payment for services, when you proceed with paying the balance of 50% deposit or invoice in full, and sign our authorization docs within 24 hours of our onboarding call.

Call

Phone call to collect your personal tax information & create a game plan for getting you back on track financially & in the right with CRA.

Authorization

Client Agreements & Sign CRA Authorization forms T1-AUTH (T1013) to allow Debbie Horovitch, Tax Fairy Godmother® to represent you to the CRA online and on the phone

Tax Preparation

T4 only years can be calculated immediately (results within 72 hours are common); others soon after providing relevant tax & deduction details

Review and Sign

Review your return details & request necessary adjustments before signing the finalized T183 eFile authorization forms

We can't solve problems by using the same kind of thinking we used when we created them.

- Albert Einstein

Pricing

Tax Fairy Godmother® fees in 2025 are still lower than CPAs, accountants, and big-name tax offices.

Fees are set to be fair and accessible for all Tax Fairy Godmother® clients:

- Lowest fees for years with less than $15k annual employment income, and for people who are multiple years behind in filing tax returns.

- Higher fees for years with more than $50k annual employment income, and for self-employed clients/years (to account for more forms and consulting consideration) consideration

- Highest fees for one year only clients

Pay After Refund service is available on multi-year client invoices, for those who need to receive money from CRA to be able to fully pay for Tax Fairy Godmother services, for a starting deposit payment of $150. PAR service fee is calculated at 5% of estimated anticipated combined refund & benefits amounts, to a maximum fee of $500 (which would be at $10,000+ anticipated combined refund & benefits), and requires the balance of the invoice to be paid within 48 hours of receiving deposits from CRA.

If a client is anticipated to owe money to the CRA, instead of receiving any, the applicable PAR fees are ZERO, with the invoice due over time or from future CRA payments.

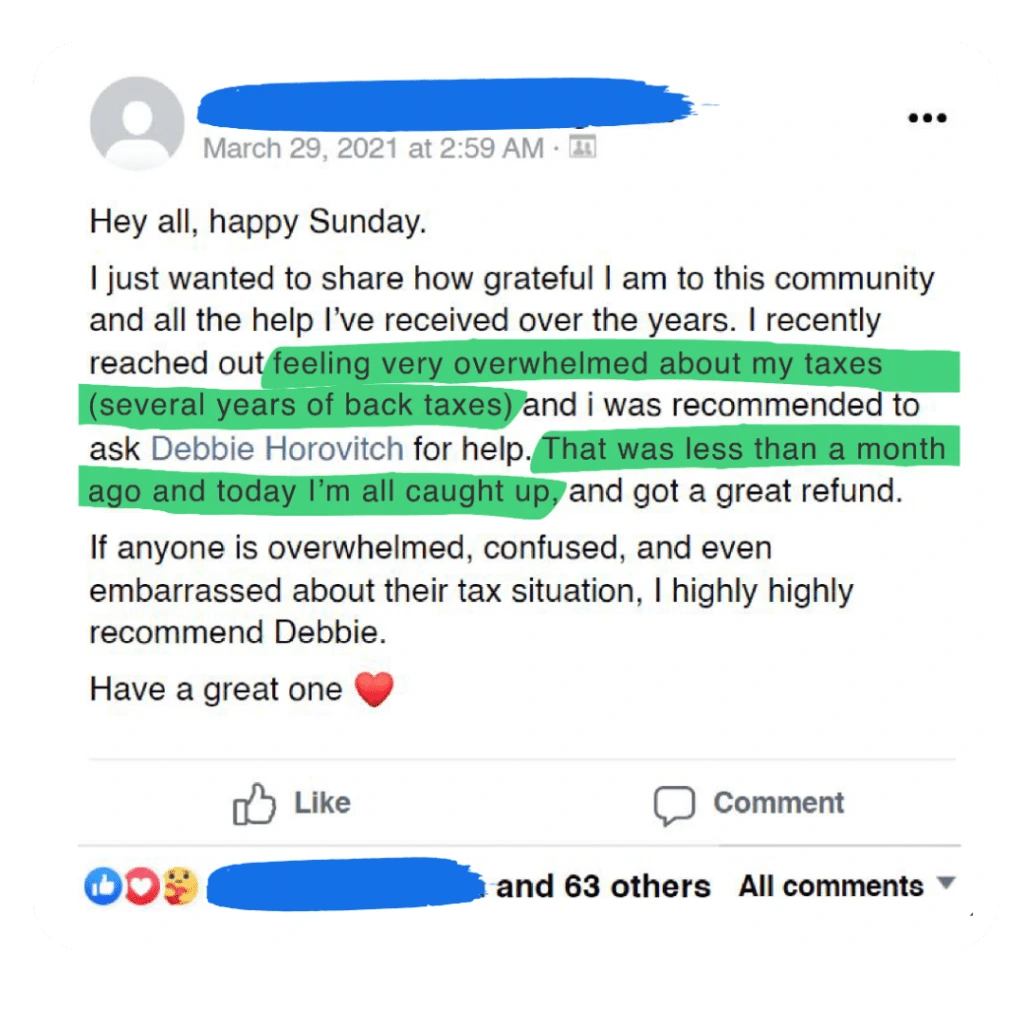

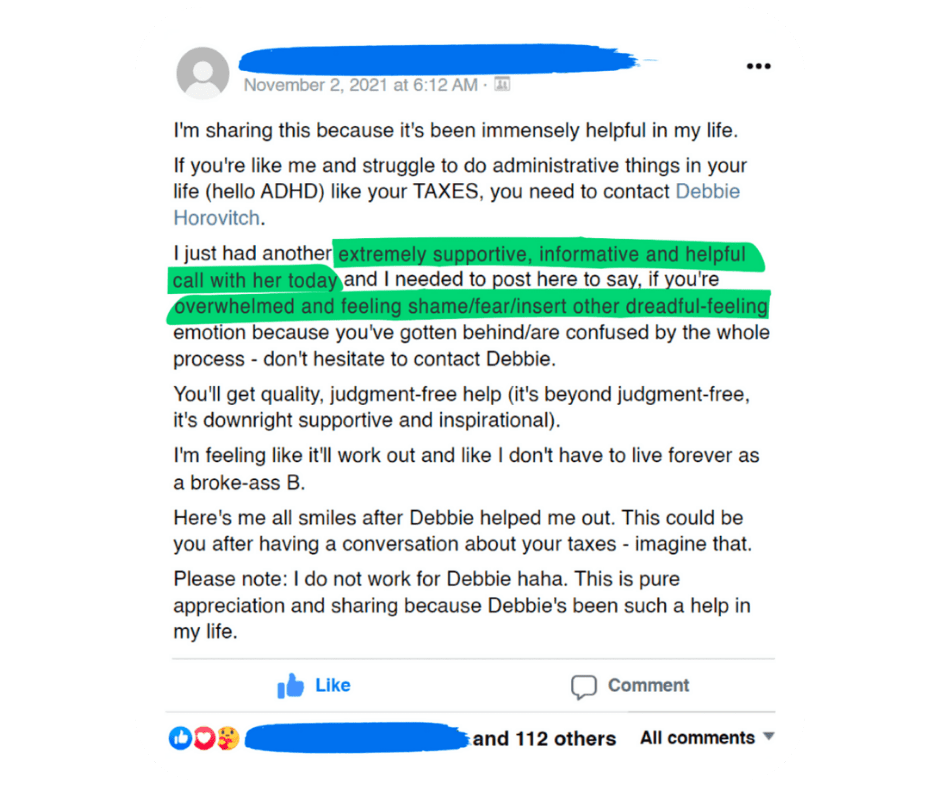

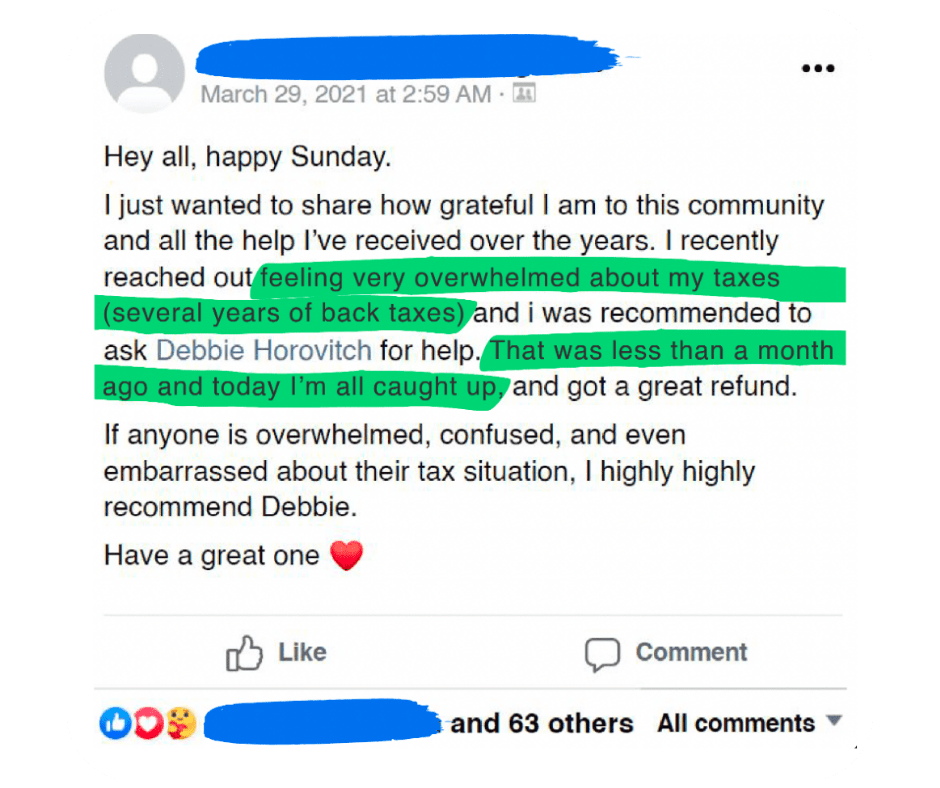

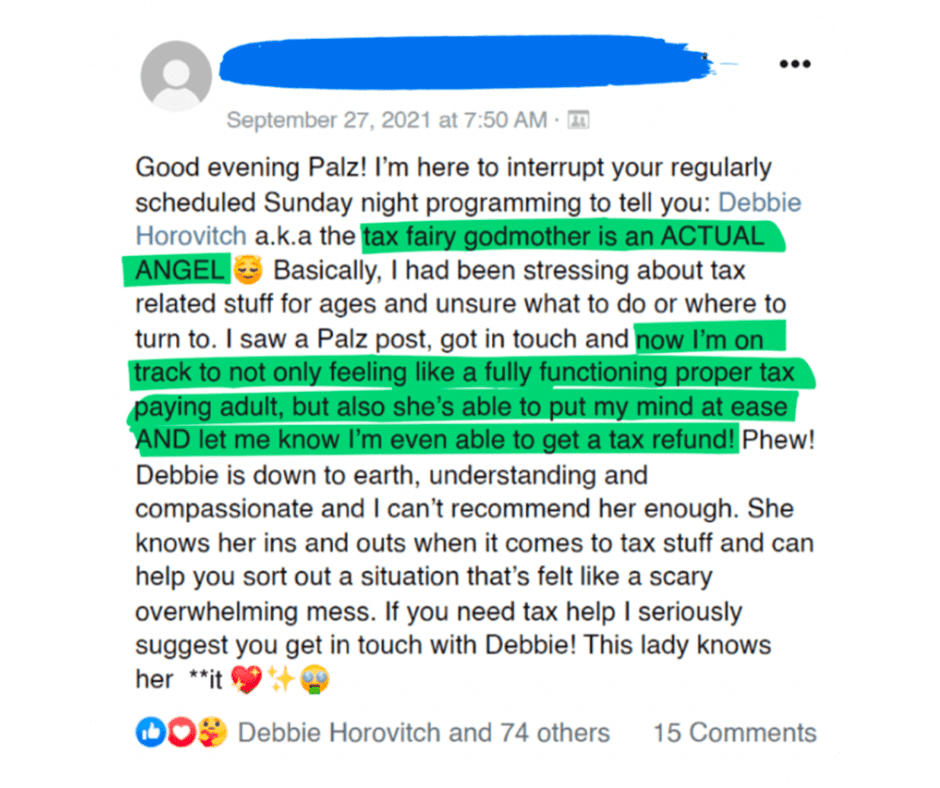

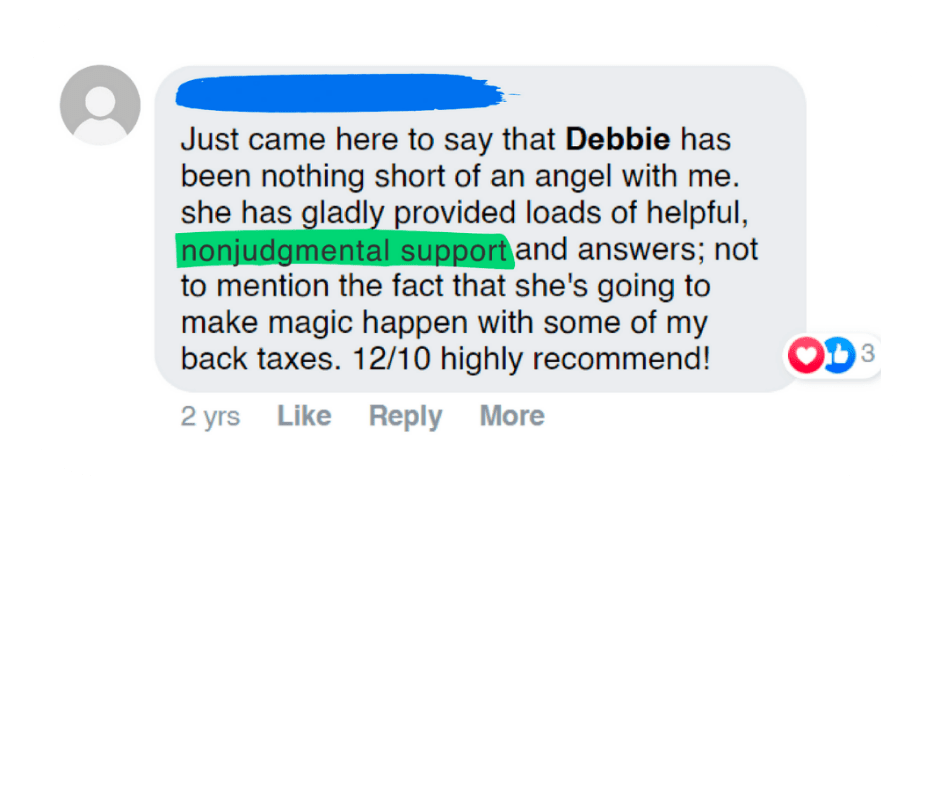

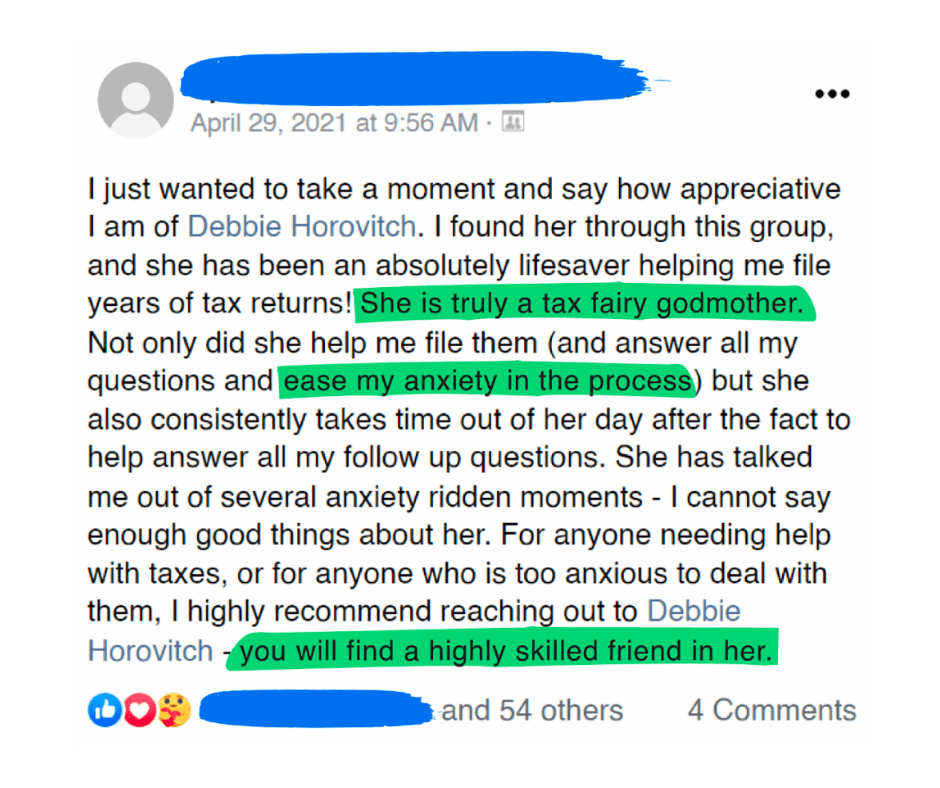

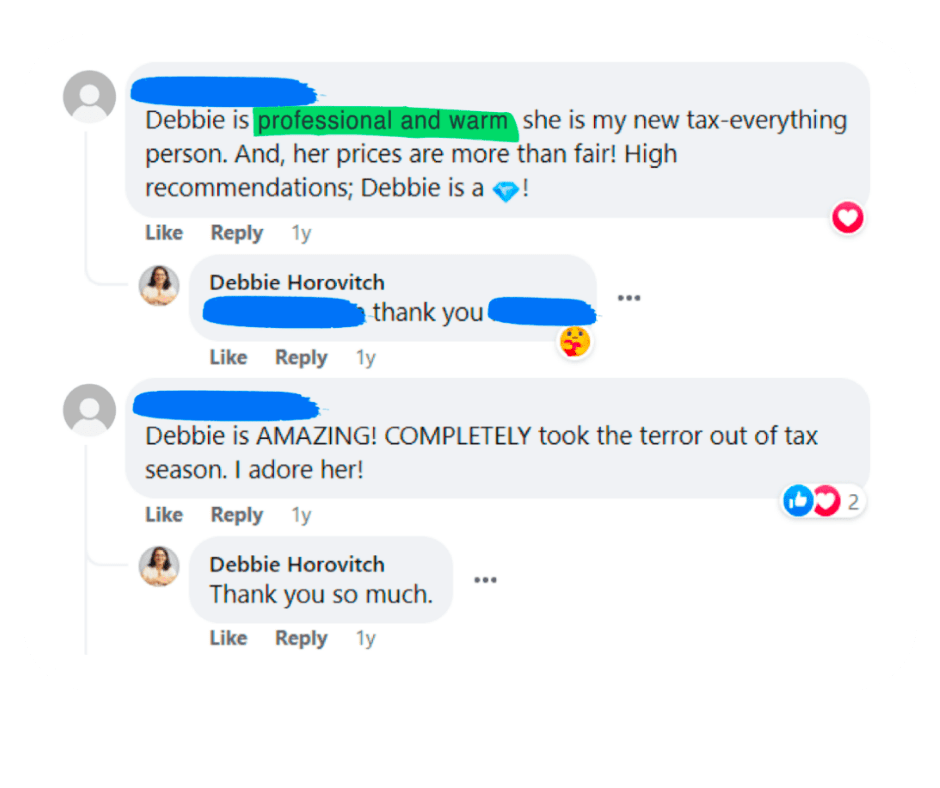

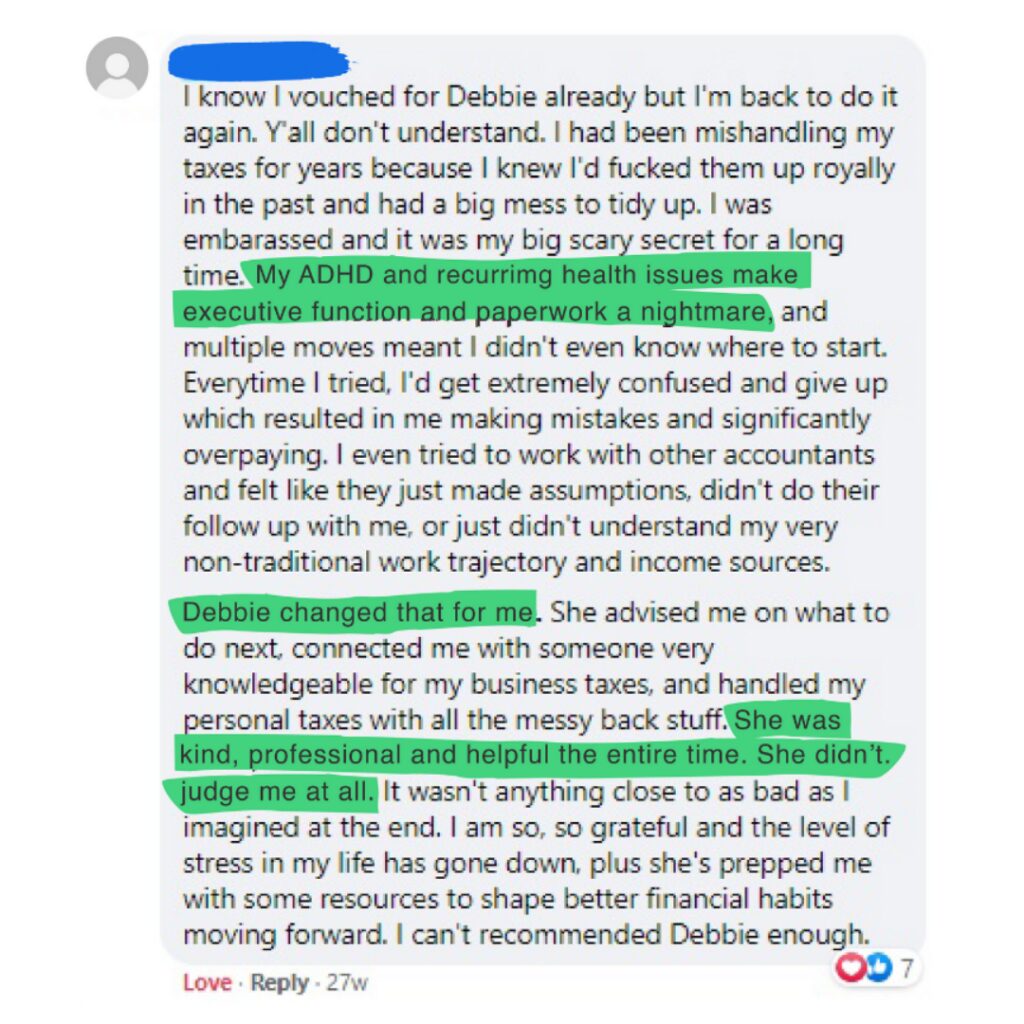

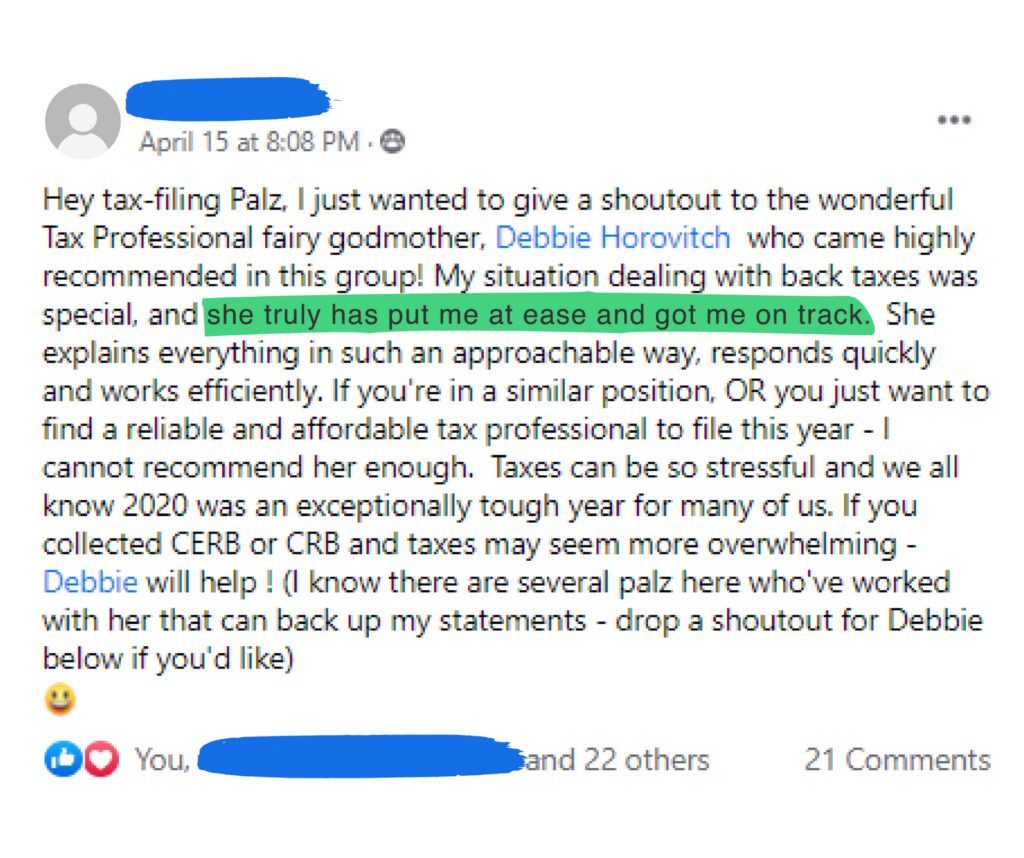

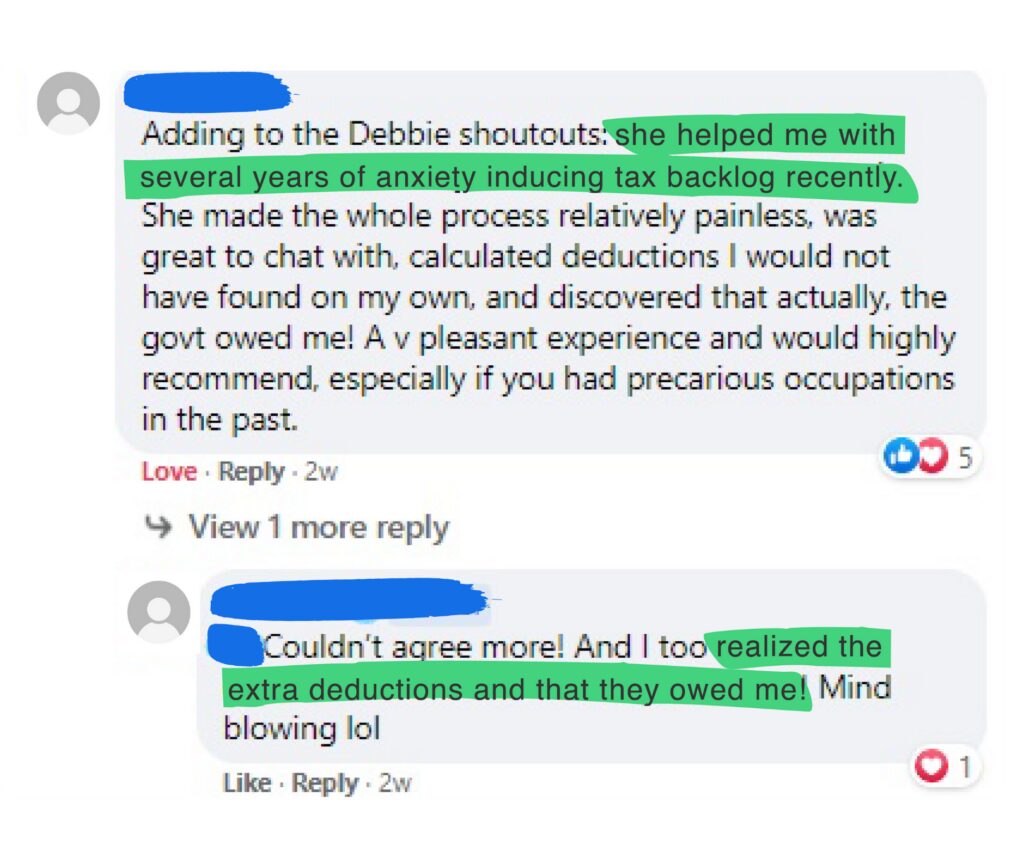

Testimonials

We couldn't be more thankful, or relieved for how Debbie helped us with our tax situation. We were paralyzed with anxiety, as well as confusion about how to proceed after years of fear. She patiently walked us through the process, the cost, and just as importantly, the compassionate understanding that gave us hope. Debbie made it a lot easier than we thought it would be, and wished we knew her years ago. We spent many sleepless years in worry. Now we are all caught up, and breathing the sigh of relief everyday. Thank you so much Debbie for offering such a comforting way to get our life back on track. Warmest Regards J&R

Debbies SHINES when she speaks about how to work with the CRA (who does that!?) and helps me feel that I can have all my questions answered, and know how to proceed. Hire her to end any shame you may feel or fear of how to move forward.

An amazing person. Every time my taxes are done by her I get my max refund. Truly a great support in all aspects. I’ve been working with her for 5 years or so. I highly recommend. Simple and easy.

Lots of great insights into Canadian tax minutia. The Tax Fairy Godmother answered all the questions and cleared up some misunderstandings that I had about businesses in Canada. Great resource

Debbie provides an efficient, easy-to-navigate and judgment-free service, which I highly recommend to anyone, but especially those who struggle with managing their finances and taxes.

Finding Debbie Horovitch, the Tax Fairy Godmother, was truly a blessing when I needed to file my overdue taxes. She was incredibly supportive and uplifting while I struggled to put together the information needed for her to file my taxes.

I highly recommend reaching out to her if you are unable to file your taxes on your own. She is efficient and professional with the filing process. Even more importantly, she reassures you that you can finally get this done. For example, Debbie patiently encouraged me that I was not alone in this process, making what felt overwhelming seem manageable.

After each conversation, I felt uplifted and confident that I could handle the situation. There was no need to stress over what others might think about me being behind. Debbie’s encouragement made all the difference.

I highly recommend reaching out to her if you are unable to file your taxes on your own. She is efficient and professional with the filing process. Even more importantly, she reassures you that you can finally get this done. For example, Debbie patiently encouraged me that I was not alone in this process, making what felt overwhelming seem manageable.

After each conversation, I felt uplifted and confident that I could handle the situation. There was no need to stress over what others might think about me being behind. Debbie’s encouragement made all the difference.

Debbie was so great to work with. If you're holding back catching up because you're afraid of what someone is going to think of you, I would recommend Debbie as she made it a comfortable experience. As embarassing as it can feel to fall behind not once, but twice, she really gets the job done without making you feel shame about it.

Debbie is truly a lifesaver! Tax season is so stressful and overwhelming, especially when you are self-employed. Debbie is very encouraging and nonjudgmental, and her rates are incredibly reasonable. She provides resources to help you get started and understand what you are entitled to. I highly recommend Debbie, particularly if you are a small business owner or solopreneur. The Tax Fairy Godmother is exactly who you need in your corner to boost your confidence and alleviate your tax worries so you can focus on growing your business. Your only regret will be not connecting with her sooner!