To promote adoption of zero-emission vehicles on Canadian roadways the federal government is continuing the iZEV programs until 2025..

The incentive for purchasing a qualifying ZEV model is either $2,500 or $5,000 on vehicles that are short-range and under the price price limit of $55,000 (not including upgrades), or long-range and under the price range limit of $60,000 (not including upgrades).

This tax incentive is applied by the dealer to your purchase receipt at the time of purchase, and it is not reported on your tax return unless the vehicle is also being included as a business asset in which case you can accelerate the CCA claims on your business activity reporting returns.

Note that donation receipts can only be claimed once, and up to a maximum claim amount of 75% of your income.

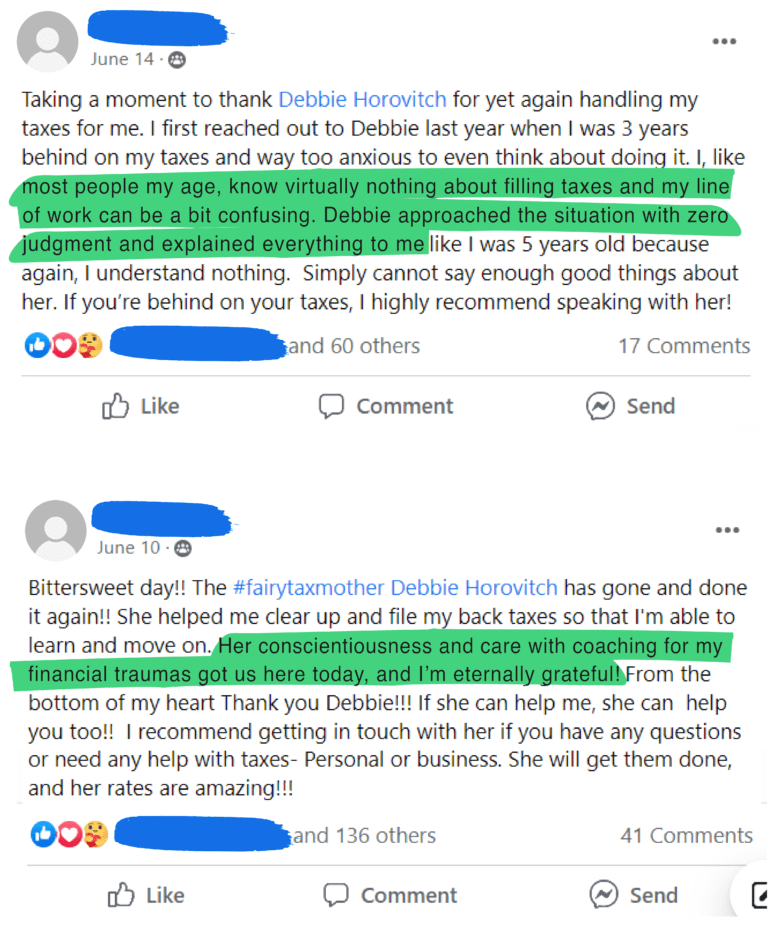

If you’d like my help with your personal tax situation, refer to the image below

Tax Fairy Godmother

Debbie Horovitch