Understanding Taxes

Here’s How You CAN Claim Your Pets on Your Taxes

Is Your Insta-Famous Cat a Tax Deduction?

Yes you can love them, and they are amazing companions, but the CRA won’t generally allow you to claim pet costs on your taxes.

Pets are not considered “dependents”, so their medical care (along with the cost of ownership) is considered to be personal consumer spending, optional, which is not tax deductible, despite their importance in our lives.

UNLESS…

1. Your pet is part of a working farm operation (registered business) and the animal has a productive role in the generation of income from farming.

You could also argue that your pet, who earns you a taxable income from social media brand sponsorships and exposure (Insta-famous), has associated business costs that are necessary to continue to generate income.

The CRA will likely require you to demonstrate that the intent of your business activities claims is to earn a profit (through a review request in the six years after you filed), so it’s a good idea to keep track of your business activities including financial transactions, clients closed & prospected, marketing activities, and time allocated.

Use professional invoices to document all your payments received, and keep on file paper or soft copies of all the receipts of expenses that you will claim for the business overall, not just associated with your pets. Here is a spreadsheet (template) you can use to topline each year of your business activities revenue & expense claims, for your tax preparer or to prepare yourself for filing:

T2125 worksheet (Note: you must take a COPY of the file first, to make any edits)

Pets that are your emotional support animals, but they are NOT specially trained for a specific task to help you, do not qualify.

I know it might not be the answer you were looking for, but at least you know.

To your financial confidence!

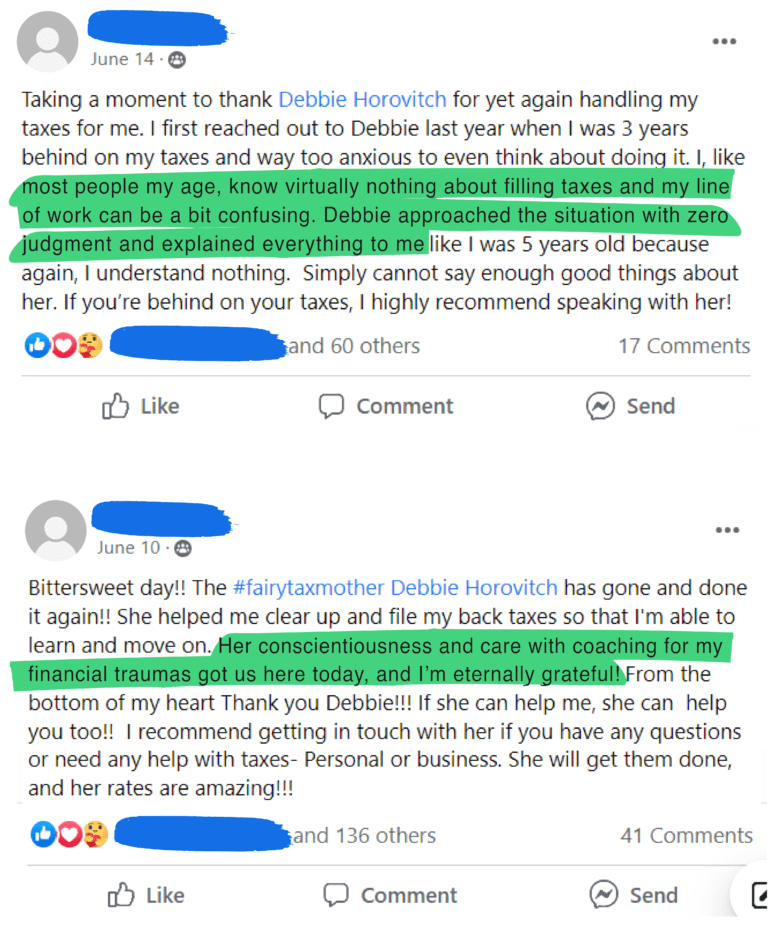

If you’d like my help with your personal tax situation, refer to the image below

Tax Fairy Godmother

Debbie Horovitch

Join Our Newsletter

❤ Follow us

Facebook Twitter Linkedin Tiktok Instagram

Ready to catch up on your taxes?

Blog posts by Tax Fairy Godmother

Tax Nightmares

Tax Nightmares

Need To Fix Your Tax Mistakes, Dispute The CRA Decision, or Request Relief of Penalties?

What If I Owe Money & Can’t Pay? Will I Go to Jail???

My Tax Fairy Godmother Origins Story

📑 Understanding Taxes

Getting Yourself Access To Your CRA My Account & My Business Account Online

Here’s How You CAN Claim Your Pets on Your Taxes

Did you login to your bank account and see MORE MONEY than you expected?

Tax Tips

Tax Tips

21 Tax Tips #21 Charitable Donations

21 Tax Tips #20 iZEV programs (Incentives for Zero Emission Vehicles)

21 Tax Tips #19 Staycation

Playing Catch-Up

Playing Catch-Up

Planning Your New Year’s Resolutions: Turning Over A New Money Leaf For The New Year

Dear Tax Fairy

Dear Tax Fairy

Will You Help Let Other Financially Stressed Canadians Know They’re Not Alone?

FREE TAX TIPS GUIDEBOOK

21 Tax Tips for Winning Financial Confidence

Little Known Tax Programs For Canadians Who Want To Pay Less Tax and Maximize Benefits

Click Here to Get your Free Ebook!

More Blogs

Getting Yourself Access To Your CRA My Account & My Business Account Online

Will You Help Let Other Financially Stressed Canadians Know They’re Not Alone?

Planning Your New Year’s Resolutions: Turning Over A New Money Leaf For The New Year

Here’s How You CAN Claim Your Pets on Your Taxes

Did you login to your bank account and see MORE MONEY than you expected?

Need To Fix Your Tax Mistakes, Dispute The CRA Decision, or Request Relief of Penalties?

What If I Owe Money & Can’t Pay? Will I Go to Jail???

My Tax Fairy Godmother Origins Story

THIS SITE IS NOT A PART OF THE FACEBOOK™ WEBSITE OR FACEBOOK™ INC. ADDITIONALLY, THIS SITE IS NOT ENDORSED BY FACEBOOK™ IN ANY WAY. FACEBOOK™ IS A TRADEMARK OF FACEBOOK™, INC. Privacy Policy, Disclaimer and Terms of Service © Copyright 2024 All Rights Reserved Debbie Horovitch, Tax Fairy Godmother THEME BY LAUNCH IT

Tax Nightmares

Tax Nightmares