While most people will not owe any significant amounts of tax income tax when they catch up on tax filing, not everyone will receive any amounts. Some people will owe income tax (more likely with untaxed earnings like tips or self-employment), or may even owe back benefits to be repaid to CRA, if they previously filed incorrectly and claimed benefit amounts that they were not actually qualified to receive.

Special considerations like relief of penalties and interest may be considered by the CRA on an individual application basis.

It’s always in your best interest to learn about the details of your situation with the advice of a qualified professional, to see if you can legally correct past mistakes that may have been made by you or the CRA, to minimize the impact on your bank accounts.

You are legally required to file tax returns, for years when you owe more money to the CRA.

If you owe money to the CRA, late-filing penalties (10% of the amount due PER MONTH) will be applied from the date the return was due, until the date your return is filed and received by CRA.

To encourage you to file, CRA will hold onto back benefits and refund amounts after 2 years late.

To compel you to file, they may freeze your bank accounts or take other legal action against you.

However, it is not a crime to not have the money to pay your debt to CRA.

As long as you have filed your returns, and are working with CRA to keep them aware of your ability to pay the debt, they will be patient with you making payments and will add interest (prime +1%) to your balance until it is paid off. When you are catching up on multiple years’ returns, CRA will usually claim your refund amounts from some years, to pay the income tax balance due in other years.

You are NOT legally required to file a tax return for years when you are due a refund or benefits.

If you are due to receive a REFUND from CRA, or if you are due back years’ benefits that you didn’t claim, you can file up to 10 years, but some benefits and credits will expire over time.

– Claims on CPP overpayments withheld on your paychecks expire after 4 years

– Claims on EI overpayments withheld on your paychecks expire after 3 years

– Principal Residence Exemption on Capital Gains from the sale of a personal-use home expires after 90 days of the tax return due date, and you cannot make a later adjustment without being penalized $100 per month, up to a maximum of $8,000

– Declaration of Holding Foreign Property Over $100,000 (T1135), must be reported separately from your tax return, by deadline, or be penalized $25 per day, up to a maximum of $2,500

CRA has the right to request documentation to prove the claims on your filed tax returns for up to 6 years after you filed, so it's a good idea to keep printed copies of all purchases you want to claim.

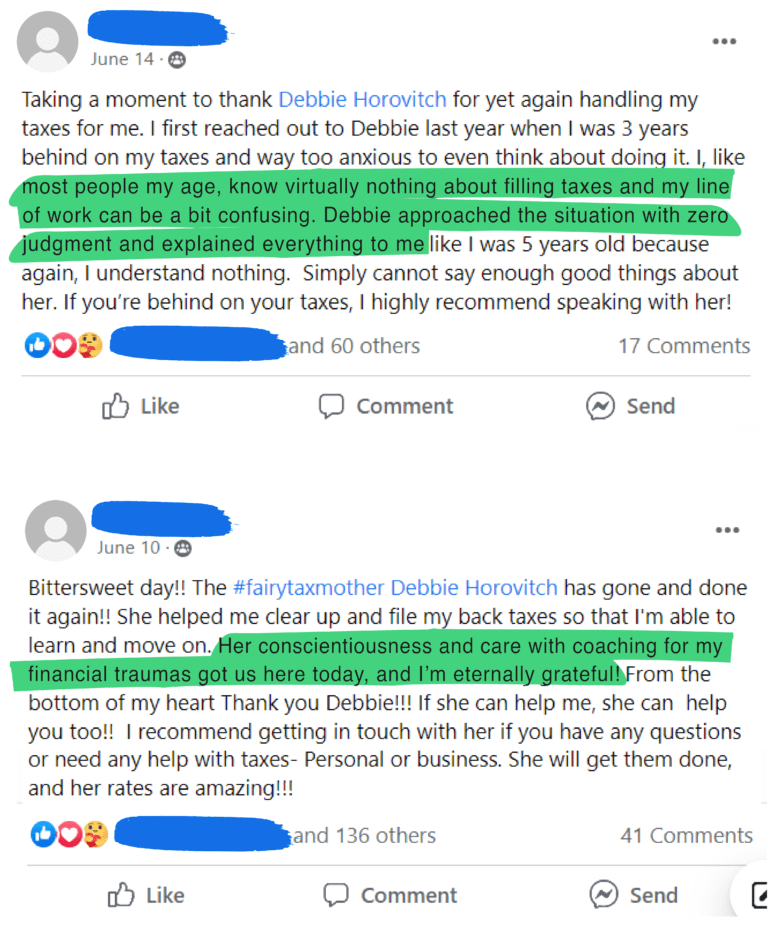

If you’d like my help with your personal tax situation, refer to the image below

Tax Fairy Godmother

Debbie Horovitch