In Ontario, your official Common-Law start date is 12 months after you begin cohabitating in a conjugal relationship, or your baby's birth date if it’s within the first 12 months of living together..

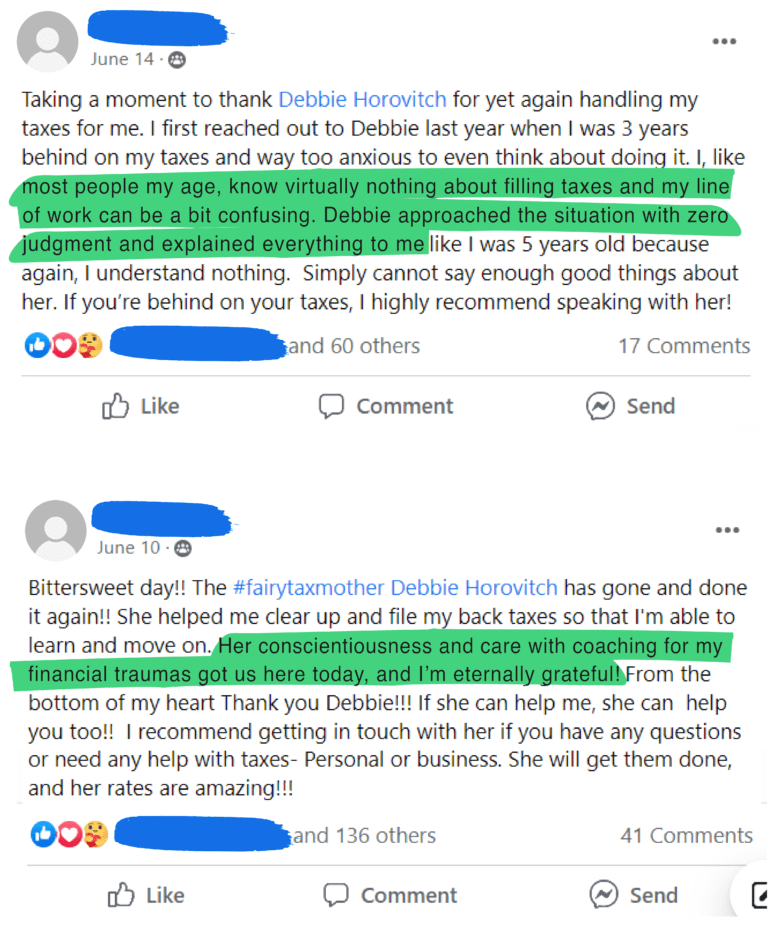

Many of my clients have been mistakenly filing as Single instead of Common-Law, because they are unaware of the actual start date, and of the tax advantages for filing accurately as Common-Law (or married)

The most common advantage is if you financially supported your spouse for the tax year (based on their income being no-income or low-income), you can claim the spousal amount, worth a little over $8,000.

Other advantages to filing as Common-Law / Married (or having your returns prepared by the same person, at the same time) include contributing to spousal RRSP, claiming the entire Home buyers Amount yourself or choosing to split with your spouse, optimizing family medical expenses and charitable donations claims for the best financial advantage. Additionally, you can transfer credits for disability amounts, age credit, pensions, and tuition.

If you have been accidentally / mistakenly filing as Single, it’s in your best advantage to phone CRA and let them know of your mistake so they can recalculate your returns and correct their records, with your help. If they discover you’ve been filing single incorrectly for multiple years, they’re more likely to apply penalties as well as clawing back the benefits you did not qualify for.

If you’d like my help with your personal tax situation, refer to the image below

Tax Fairy Godmother

Debbie Horovitch