Similar to cash gifts, insurance, and legal judgment payment, windfalls, and inheritances received, lottery winnings and most gambling winnings in Canada are not considered income and do not need to be reported on tax returns.

However, gambling activities might be considered business activities by the CRA and therefore become taxable by law. The determination of gambling activities as a business (instead of a hobby), is in the unusual occasion when the taxpayer has implemented a system to increase the likelihood of profits, more so than an enthusiastic hobbyist.

For more details and information please visit the links below:

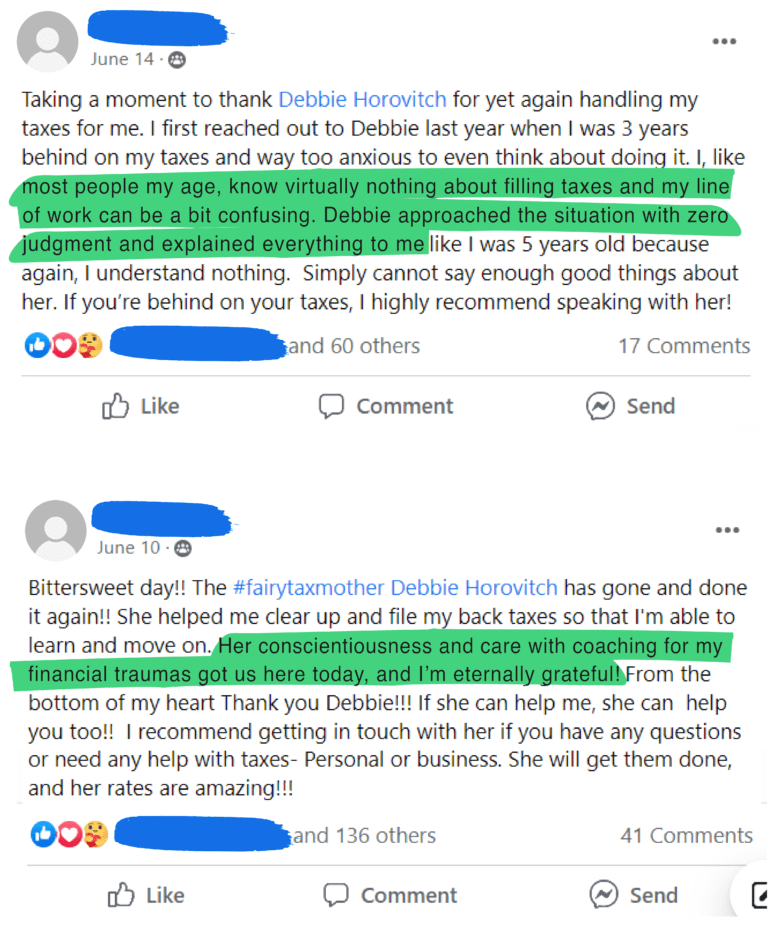

Tax Fairy Godmother

Debbie Horovitch