If you pay rent or property taxes and your income is under the maximum qualifying amount, you can claim these amounts paid on your tax return to receive the Ontario Energy and Property Tax Credits portion of Trillium Benefits for Ontario residents.

Even if you did not pay rent or property taxes you will still likely qualify for Trillium benefits under the maximum qualifying amount – Ontario resident benefits are usually between $275 and $1,100 per year, and including a claim for rent dramatically increases it from the lower levels.

Should CRA request documentation of the rent paid, they will accept a rent receipt from your landlord that states your name, the address of the unit that you've rented, as well as the total amount of rent paid throughout the year. They will also usually accept bank statements, canceled cheques and other proof showing the amount of rent transferred each month to your landlord on the first of the month

For more details and information, Please Click the CRA website here: Paying Personal Rent/Property Taxes:(Trillium Benefits & OEPTC)

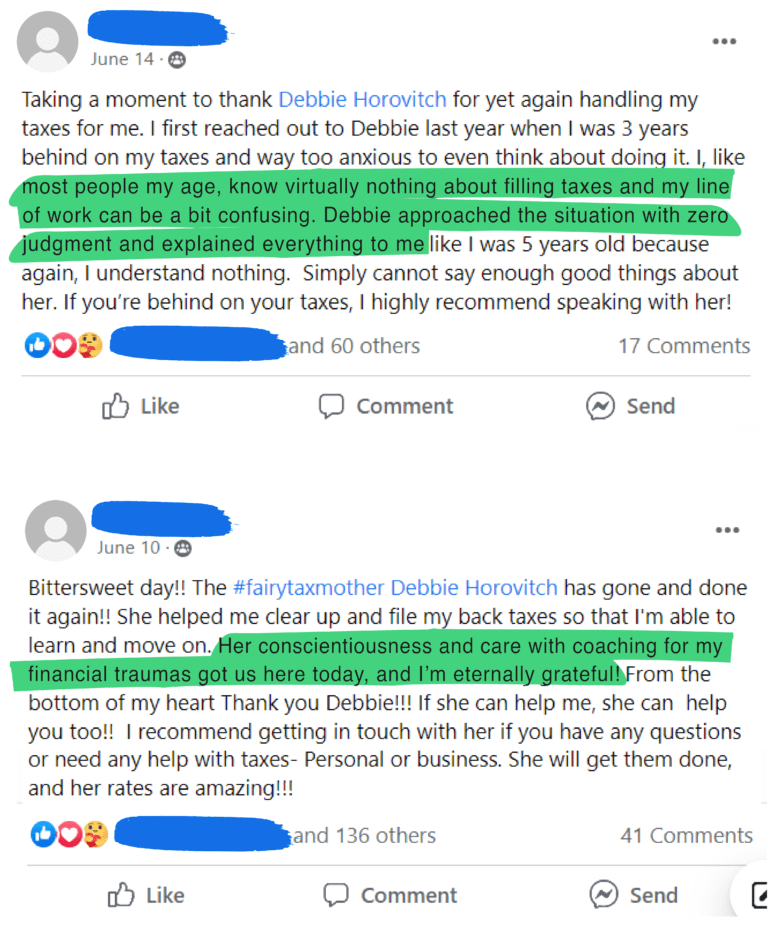

If you’d like my help with your personal tax situation, refer to the image below

Tax Fairy Godmother

Debbie Horovitch