Adjust Previously Filed Returns

– Apply to have the CRA include a line by line adjustment (and recalculation of refund amounts), to your previously filed and assessed tax returns.

Voluntary Disclosure Program

– On previously filed returns, correct mistakes that CRA hasn’t yet caught, and apply for forgiveness of penalties & interest.

Taxpayer Relief Request

– Apply for relief on penalties & interest applied to income tax amounts due to the CRA, that you are unable to pay for, due to financial hardship, health issues, or reasons beyond your control.

Disability Tax Credit

– Apply for an additional income deduction on your returns, for each year of medically confirmed disability or infirmity.

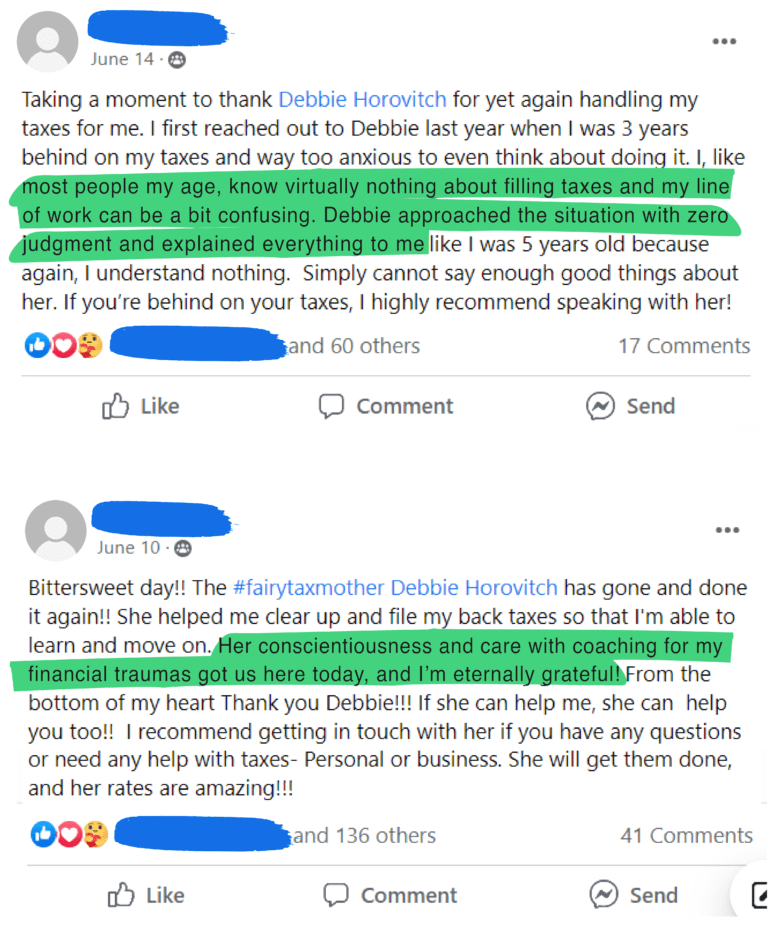

If you’d like my help with your personal tax situation, refer to the image below

Tax Fairy Godmother

Debbie Horovitch